Everyone's blaming the oil price collapse and China's sliding economy for the rout of the stock market these first two weeks of 2016. That's part of the story, but there may also be a policy explanation for the bearish sell-off.

The big fall-off-your-chair moment during President Obama's State of the Union address came when he proclaimed: "We've cut our imports of foreign oil by nearly 60 percent, and cut carbon pollution more than any other country on Earth. Gas under two bucks a gallon ain't bad, either."

Global stock markets sank almost across the board Thursday as pessimism over falling oil prices and another dive on Wall Street held sway, despite some data showing economies are on the mend.

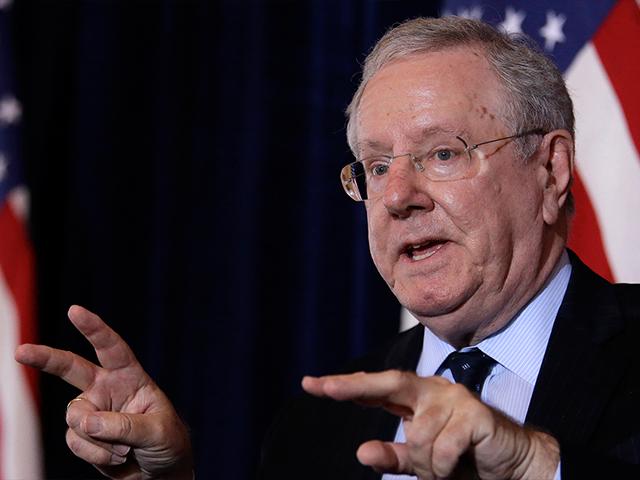

Author and former presidential candidate Steve Forbes says the Republican presidential candidates should follow his economic plan to get America back on track.

Oil prices are getting closer to just $30 a barrel, the lowest they've been in 12 years.

The great Jack Kemp used to say about politicians that "voters don't care what you know until they know that you care." Republicans say they care about the poor and minorities, but do they really?

The last decade of financial upheaval has been one of the worst in our nation's history. Is there any way out of the mess we're in? Steve Forbes says there is -- and he has a plan.

U.S. stocks ended their worst week since 2011, rattled by concerns over a scary selloff of Chinese stocks. But U.S. stocks sold off more, with the Dow down nearly 170 points.

Financial markets around the world have been hit hard in the first couple of days of 2016. So what's behind the sell-off?

The first trading day of 2016 ended in a slump. Investors worldwide dumped shares throughout the day based on new fears of a Chinese economic slowdown as well as over fresh turmoil in the Middle East.