America's debt is growing by $1 trillion every 100 days, and economists warn that if Congress doesn't take action it's only going to get worse.

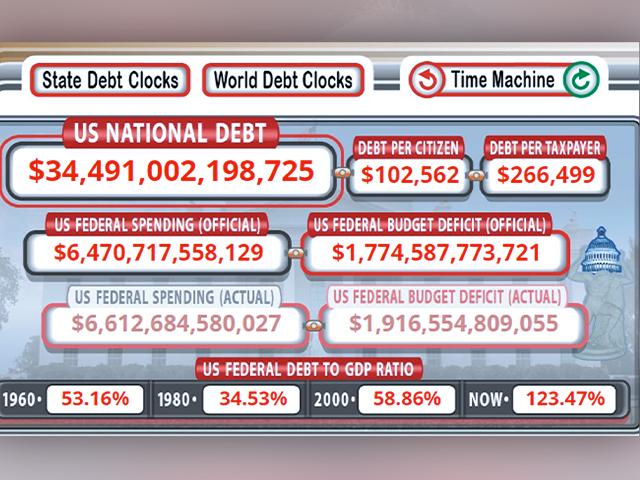

The U.S. national debt, the money our federal government borrows to cover operating expenses, now stands at more than $34 trillion. If that's not bad enough, the rapid rise in interest rates has pushed the annual payments on the debt far higher, threatening to bring a potential future crisis.

"Right now, we're paying about $750 billion per year in interest costs, which again, is approximately equal to the amount the United States spends on National Defense, if you can believe it," said Dr. Alexander Salter, associate professor of economics at Texas Tech University.

Dr. Salter says some forecasts predict the interest payments alone will soar well past the $1 trillion mark and could double by 2033. According to the Peter G. Peterson Foundation, that's more than America spends on the Department of Defense ($816.7 billion, in 2023), National Security ($30.3 billion, in 2023), and federal spending on children ($761 billion, in 2022) and several supplemental programs.

He also explains how the biggest drivers of the growing national debt are not solely driven by outlandish government spending, fueled instead by Social Security, Medicare, and Medicaid. Spending on those programs leaves the federal government required to pay an estimated $200 trillion in future obligations.

"This is why we have to understand that military aid to Ukraine and Israel, which we can debate those issues on their merits, and we should – but if we're talking about 50 billion or 100 million, that's a drop in the bucket in terms of long-term fiscal trajectory," said Dr. Salter. "We're not going to fix things by shaving things off, we need fundamental structural reforms."

Economists agree that the risk to America's credit rating and its ability to raise funds makes debt likely to become one of the biggest threats to our national security, because the U.S. wouldn't be able to afford the military resources it will need.

"If you can't place your bonds, if you can't command resources; you can't pay for tanks and fighter planes, and bombs, and all the things that you need to keep the country safe," said Dr. Salter.

Joel Griffith, research fellow for economics at the Heritage Foundation, told CBN News the worst is yet to come.

"We are paying for it now with these high inflation rates, and so sorry to be the messenger of bad news, it is going to get far worse in the coming decades," he said. "Of course, we have a presidential election coming up and it's very important that we have a candid discussion and debate about what these candidates would do to stop us from going off the fiscal cliff."

Did you know?

God is everywhere—even in the news. That’s why we view every news story through the lens of faith. We are committed to delivering quality independent Christian journalism you can trust. But it takes a lot of hard work, time, and money to do what we do. Help us continue to be a voice for truth in the media by supporting CBN News for as little as $1.

Support CBN News

Support CBN News